Call option profit formula

Profit 8 x 100 x 3. Call Option Calculator is used to calculating the total profit or loss for your call options.

Value At Expiration And Profit For Call And Put Options Analystprep Cfa Exam Study Notes

The covered call strategy involves the investor.

. This final sum represents the total profitloss. Download The 12000 Word. Profit 13 per share x 10 shares 130 144 return 130 900.

Its free Options Trading 101 - The Ultimate Beginners Guide To Options. The long call calculator will show you whether or not your options are at the money in the money or out. So if an investor had paid 260 in premiums for these options contracts the calculation would be.

To avoid some of the risks associated with short calls an investor may choose to employ a strategy known as the covered call. Download The 12000 Word Guide. 1600 - 260 1340.

Outright purchase of XYZ shares at 90. Profit for a call seller max0ST Xc0 m a x 0 S T X c 0. The arithmetic average mean is 2100 2200 2400 3 2233.

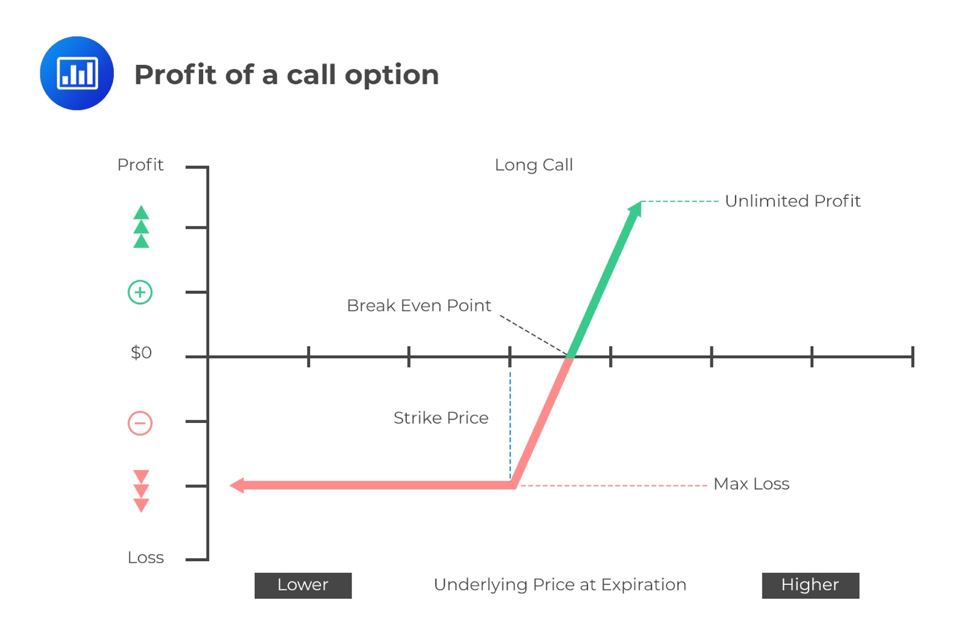

This modified Asian call option is then priced explicitly leading to a formula that is strikingly similar to. The buyer of the call option has no upper limit on the potential profit and a. An call options Value at expiry is the amount the underlying stock price exceeds the strike price.

The Profit at expiry is the value less the premium initially paid for the option. Breakeven BE strike price option premium 145 350 14850 assuming held to expiration The maximum gain for long calls is theoretically unlimited regardless of the. To calculate the profit on a call option take the ending price of the stock less.

Call profit formula. Where c0 c 0 the call premium. Purchase of three 95 call option contracts.

An call options Value at expiry is the amount the underlying stock price exceeds the strike price.

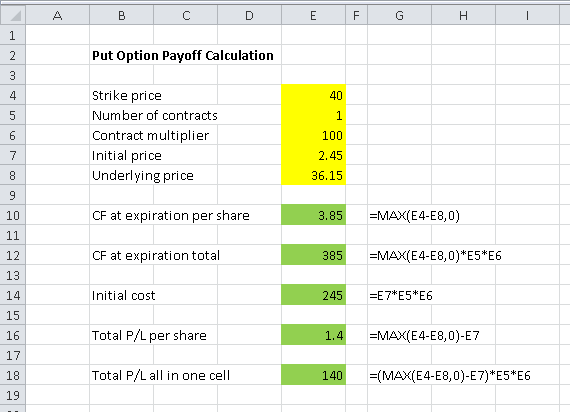

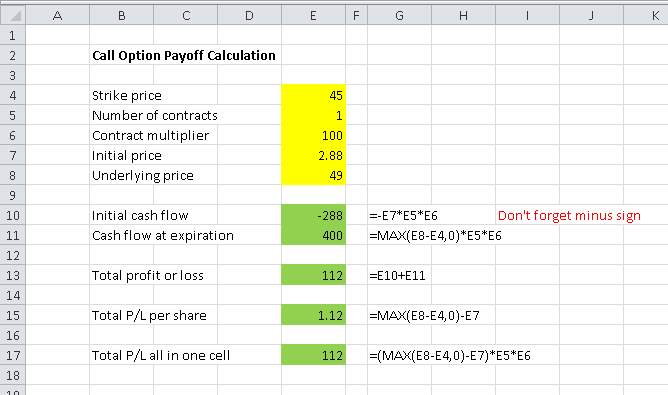

Calculating Call And Put Option Payoff In Excel Macroption

How To Calculate Payoffs To Option Positions Video Lesson Transcript Study Com

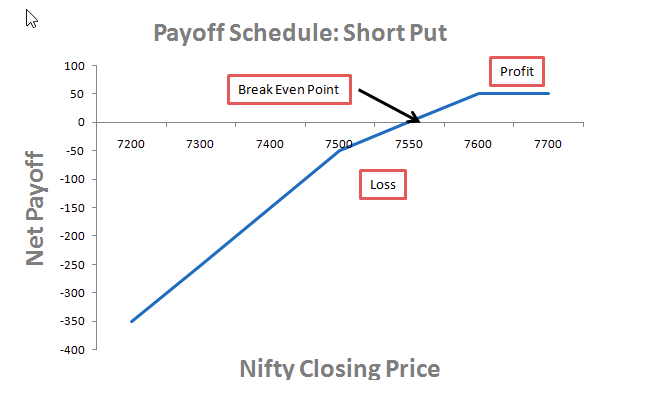

Summarizing Call Put Options Varsity By Zerodha

Call Option Calculator Put Option

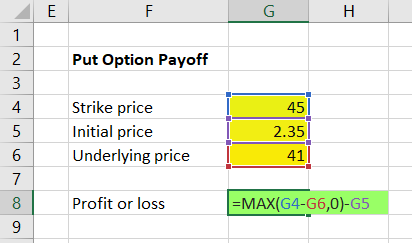

Put Option Payoff Diagram And Formula Macroption

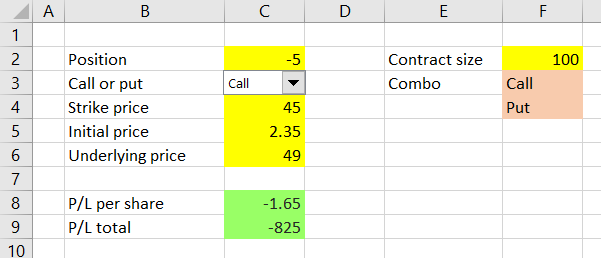

Calculating Option Strategy Payoff In Excel Macroption

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

:max_bytes(150000):strip_icc()/dotdash_Final_Measure_Profit_Potential_With_Options_Risk_Graphs_Mar_2020-01-91faf67825434baba1a46837f4bf1ef3.jpg)

Measure Profit Potential With Options Risk Graphs

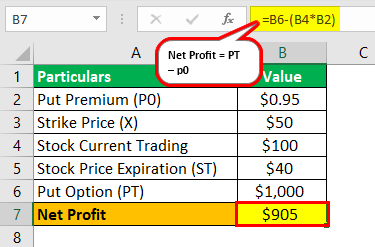

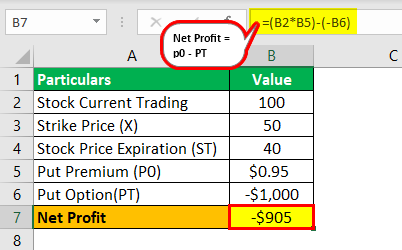

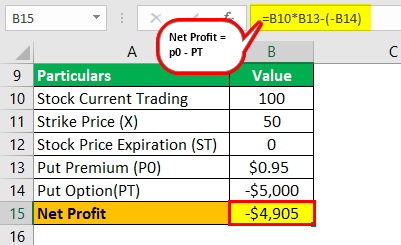

Put Options Definition Types Steps To Calculate Payoff With Examples

Calculating Call And Put Option Payoff In Excel Macroption

Call Option Payoff Diagram Formula And Logic Macroption

Put Options Definition Types Steps To Calculate Payoff With Examples

Put Options Definition Types Steps To Calculate Payoff With Examples

Options Payoffs And Profits Calculations For Cfa And Frm Exams Analystprep

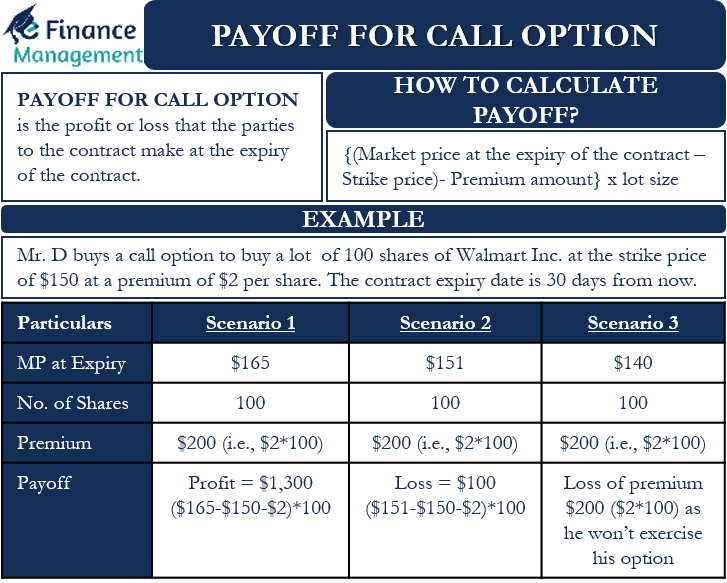

Payoff For Call Option Meaning Calculation And Examples

Put Options Definition Types Steps To Calculate Payoff With Examples

Call Option Understand How Buying Selling Call Options Works